Contents

Our acquisition of CP Pharmaceuticals in Wales, UK, is a good example. It has given us immediate access to a large base of customers in the UK, including hospitals and the National Health Service. The acquisition has made Wockhardt the largest Indian pharmaceutical company in the UK and one amongst the top 10 generic inorganic growth meaning companies in the country. I would not say that acquisition-led growth is always better than organic growth. The recent Rhone Poulenc acquisition was integrated with Nicholas Piramal in a period of 12 months, while the acquisition of the ICI pharma business was integrated in a record period of five months.

The strategy adopted shall depend on the purpose or organizational goals and hence a different strategy shall apply to different companies. Corporate Restructuring aims at different things at different times for different companies and the single common objective in every restructuring exercise is to eliminate the disadvantages and combine the advantages. Corporate Restructuring means re-arranging business of a company for increasing its efficiency and profitability. Restructuring is a method of changing the organizational structure in order to achieve the strategic goals of the organization.

The government has also taken various steps to promote development of business enterprises in India. There are various promotional schemes started by the government in various laws, such as FEMA, Income https://1investing.in/ Tax Act, GST, Securities Act etc. The government has also given emphasis on ease of doing business. The government has also increase FDI limits in various sectors and ease FEMA Rules and regulations.

External Growth Strategy

In an organic growth strategy, there is change in the business model, along with management styles, financial structure etc. This would ensure that the transferee company is not subjected to cumbersome formalities for the transfer of assets and liabilities in its own name. Further, in such cases, the shell of such company should be allowed to be dissolved without winding up with court intervention. The present Act does not permit this form of merger in view of the specific definition of company under section 390 of the Companies Act. The Committee noted that apart from amendments to the Companies Act, suitable changes may be necessary in the Income Tax Act, Foreign Exchange Management Act and provisions relating to IDR to enable merger of an Indian Company with foreign entity. The Committee therefore recommended adoption of international best practices and a coordinated approach while bringing amendments to the code of merger in the Companies Act.

Accenture reported revenue of $15 bn, up by 28% in c/c (22-26% guidance range) on a YoY basis and flattish on a sequential basis in a seasonally weak quarter. Growth was broad-based with all verticals, geographies, and services growing in strong double-digits. Growth was led by products and communication technologies which grew 34% and 32% respectively. Europe and growth markets both grew 30% and above North America which grew 26%.

However, because the procedure is pricey, firms must be certain that the benefit achieved is significant. Two companies’ financial resources are typically bigger than one company’s alone, allowing for further investments. A conglomerate merger occurs when two completely different businesses unite. This form of merger and acquisition is commonly used to grow into new industries.

On the other hand, organic development takes longer, as it is a slower process to accumulate new clients and expand enterprise with existing customers. A mixture of each organic and inorganic development is ideal for a corporation, because it diversifies the income base with out relying solely on current operations to grow market share. Typically, the natural growth rate also excludes the impression of overseas trade, and it can be adverse. Mergers, demergers, disinvestments, takeovers, joint ventures, franchising, strategic alliances, slump sale are some options that are adopted as a measure to achieve inorganic growth strategy. One of the greatest benefits of a merger or acquisition is the increase in market share.

- The five major types of mergers are conglomerate, congeneric, market extension, horizontal, and vertical.

- There are some ways by which a company can enhance sales internally in an organization.

- Acquisitions and acquisitions are manifestations of an inorganic growth process.

- The Appointed Day or Date of amalgamation given in the scheme of amalgamation is taken as the date of amalgamation for the purpose of Sectionn72A.

- What are the relative strengths of the brands in question?

Through inorganic growth, you’re gaining the advantages of an entire firm’s prior sales and relationships, which implies you’re immediately gaining markets and clients that you just otherwise may not have had entry to. In this instance, firm A, the safer investment, grew income by 5% via natural progress. Organic growth does not result in any change of corporate entity. Using IMI’s expertise, Pan American Energy eliminated excessive vibration and poor fluid control in its water injection control valves and pumps, avoiding costly shutdowns and upkeep costs. Growth via market penetration doesn’t contain shifting into new markets or creating new products; it is an attempt to extend market share utilizing your present services or products.

Tips for Startups and Businesses from Swiggy’s Business Mod…

Carry out this technique by decreasing the price of a services or products, or by growing advertising efforts to lure customers away from competitors. The most used ways are inner growth or external progress through acquisitions and alliances. The Ansoff Matrix is a great software to map out a company’s choices and to make use of as starting point to check growth methods primarily based on standards corresponding to speed, uncertainty and strategic significance. Alliance is an approach in which two or more companies agree to pool their resources together to form a combined force in the marketplace.

The two main types of amalgamation are amalgamation in the nature of a merger and amalgamation in the nature of a purchase. To understand both these types in detail let us go through them one by one. Existing company A takes over the business of another existing company B which is wound up. Strategic alliances allow organizations to pursue opportunities at a faster pace. It provides access to additional knowledge and resources that are held by the other party.

Related Terms

Both businesses are in the same industry, serve the same clients, and are in the same stage of development. Joint Venture is a right option for inorganic growth when both the parties to the transaction have unique strength and want to come together to leverage the strength of each other without affecting their present structure or ownership. With the advent of globalization and increasing business opportunities,…… Know More. As companies in the industry try to cope with the implications of these changes, a number have turned to strategic alliances to test new business models and market opportunities. When the conditions for the amalgamation in the nature of merger are not satisfied, the same is termed as Amalgamation in the Nature of Purchase. In this method, a transferor company acquires a transferee company and the shareholders of the transferee company do not have any proportionate shareholding in the amalgamated company.

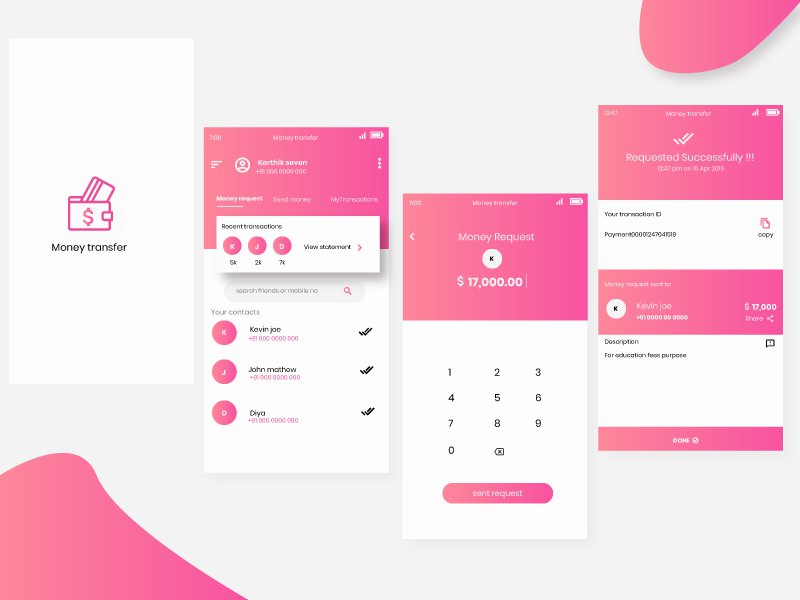

Some examples of businesses that have implemented successful organic growth strategies are illustrated in the charts below for Dominos UK, Apple and Costa Coffee. This involves acquiring corporations which might be leaders in their respective fields to strengthen IMI’s market share. Two examples are IMI’s Severe Services platform acquisition of German industrial valve maker Zimmermann & Jansen in 2010 and the main Italian engineering business Remosa in 2012. These enabled IMI to turn into the leader in custom engineered valve and management options for important in-plant processes. Both firms operated in power era and oil and gas, industries by which IMI already had a wealth of expertise.

The supply shortage has been a bottleneck for growth for Indian IT though the situation is improving. Accenture’s commentary on the drivers of strong demand was unchanged— compressed transformation across industries post-Covid and deep expertise across domain and technology and access to quality tech talent at scale. Cloud and digital transformation are still at early stages. Companies are advancing transformation programs as they realize value from early initiatives.

RESOURCES

Having acquired, one must integrate “” efficiently and quickly “” in order to derive benefits. Is also usually more sustainable than inorganic growth, as it is not dependent on external factors such as the economy’s health or another company’s success. On the other hand, inorganic growth can be more volatile, as it can be affected by these external factors. Is achieving objectives through internal means, which can be contrasted with external growth, which relies on acquiring new resources through mergers, acquisitions, or partnerships. Organic growth is achieved by using your existing resources to expand your business.

Our Service Offerings

Businesses should concentrate on entering new markets since this might open up a new market for sales. Finally, increasing marketing efforts can also help raise awareness of a business and its products or services, leading to more sales. Organic growth involves expansion from within a business, for example by expanding the product range, or number of business units and location.

Needless to say, in the context of increasing competitiveness in the market, speed is of the essence, especially in an expanding and vibrant economy like ours. A sign of corporate readiness, skill and stratagem is the ability to do such mergers and acquisitions with ‘digital’ speed. E-governance could provide a helpful tool in achieving the objective of speed with provisions for online registration, approvals etc. The process of mergers and acquisitions in India is court driven, long drawn and hence problematic. The process may be initiated through common agreements between the two parties, but that is not sufficient to provide a legal cover to it. The sanction of the High Court is required for bringing it into effect.